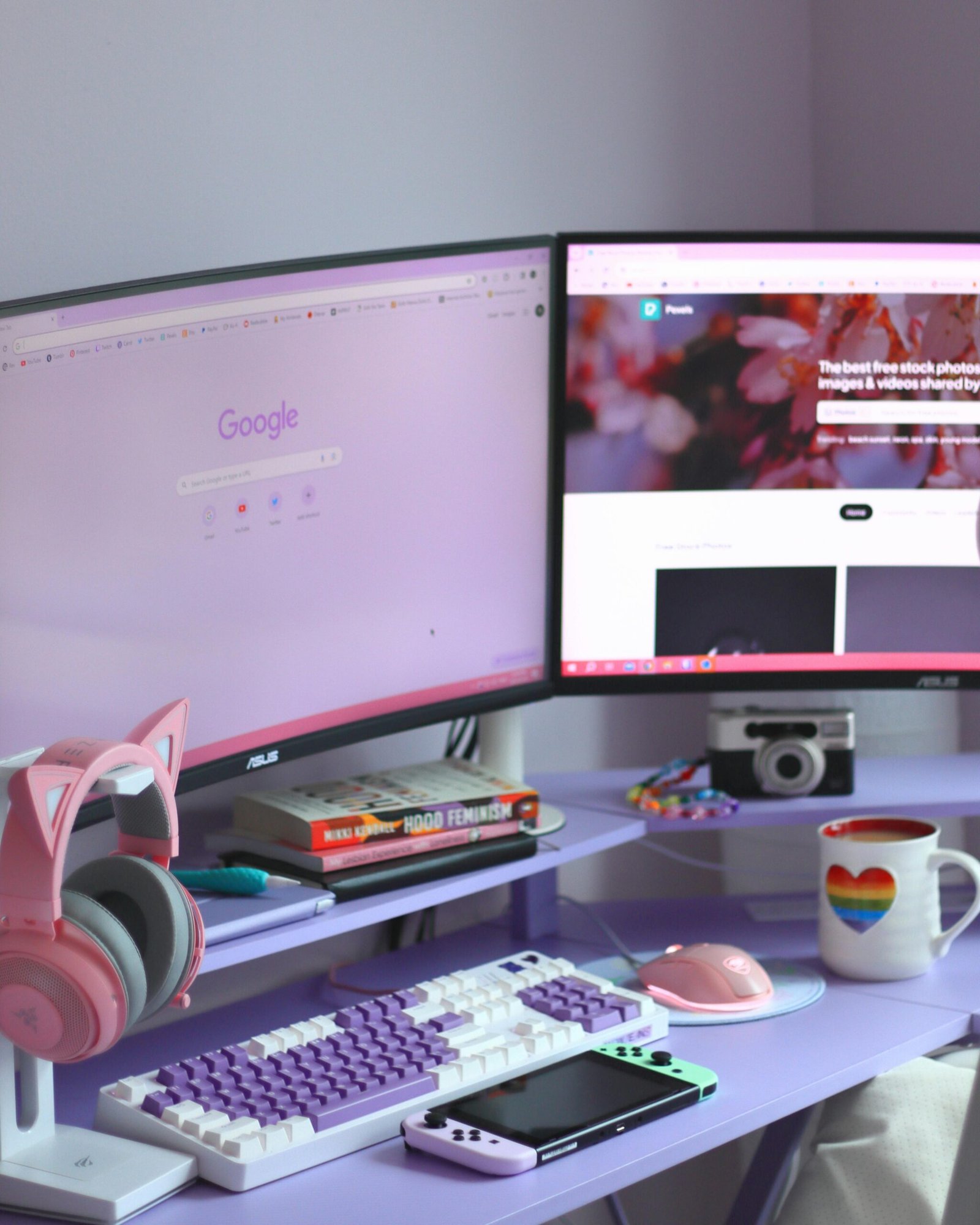

Services

At DigitalSo, we offer a comprehensive range of services designed to empower businesses in the digital age.

Software Application

We specialize in creating custom software applications tailored to your business needs, ensuring enhanced functionality, scalability, and seamless user experiences to drive operational efficiency.

Website Development

Our expert team develops dynamic and engaging websites that are visually appealing, user-friendly, and optimized for performance, helping businesses establish a strong online presence.

Ecommerce Solutions

We offer comprehensive eCommerce solutions, including platform development, payment gateway integration, and secure checkout systems, enabling businesses to sell products and services online effortlessly.

Responsive Website

Our responsive website design ensures your site adapts seamlessly across all devices, delivering a consistent and optimized user experience whether viewed on desktop, tablet, or mobile

ERP Development & Customization

We provide end-to-end ERP implementation and customization services, integrating key business processes into one platform to enhance efficiency, data accuracy, and decision-making capabilities.

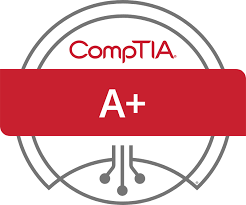

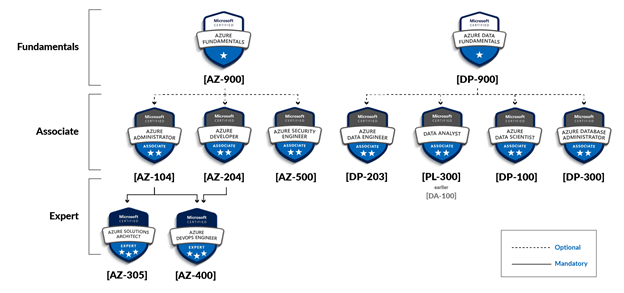

Provide Certification Course Training

We provide professional training and certification with highly competent trainers. Additionally, we guarantee 100% certification, and after certification, there are also employment opportunities. So, choose your course today!

- AWS Certified Cloud Fundamental

- AWS Certified Cloud Professional

- AWS Certified Cloud Associates

- AWS Certified Cloud Specialist

- Certified Kubernetes

- PMP Certification

- CompTIA A+ Certification

- CompTIA Network Certified

- CompTIA Security+

- CISM Certification

- CISA Certification

- ITIL Foundation

- C|EH Certified Ethical Hacker

- C|HFI Certification

- C|CSE Certified Cloud Security Engineer

- CCNA Cisco Certified

- CCNP Cisco Certified Professional

- MCSE Microsoft Certified System Engineer

- Microsoft Azure Certification

Certification

Certification & Consulting Services

Business certifications play a crucial role in ensuring compliance, quality, and ethical practices within an organization. Below are key certifications that businesses obtain to enhance credibility, meet international standards, and improve operational efficiency:

-

Halal Certification

Ensures that products comply with Islamic dietary laws, verifying that food, cosmetics, and pharmaceuticals are produced according to Halal standards. -

ISO (International Organization for Standardization)

A globally recognized set of standards covering quality management (ISO 9001), environmental management (ISO 14001), information security (ISO 27001), occupational health & safety (ISO 45001), and many more. -

BSCI (Business Social Compliance Initiative)

A leading supply chain management system that helps companies improve social standards in global production, ensuring fair wages, safe working conditions, and no child labor. -

SedEx (Supplier Ethical Data Exchange)

A certification focused on ethical business practices, labor rights, health & safety, and environmental performance, helping businesses build a responsible supply chain. -

SQA (Social & Quality Audit)

A comprehensive assessment that evaluates both social and quality compliance in manufacturing and service industries, ensuring adherence to regulatory and customer-specific standards. -

GOTS (Global Organic Textile Standard)

The world’s leading standard for organic fibers, covering ecological and social criteria, ensuring sustainable textile production from raw material sourcing to finished goods. -

GRS (Global Recycled Standard)

A certification that verifies the presence and percentage of recycled materials in products, ensuring sustainable and responsible production processes in the textile and apparel industry.

These certifications help businesses gain a competitive edge, build customer trust, and expand into global markets.

Employee of Record (EOR)

An Employer of Record (EOR) is a third-party entity that officially hires employees on behalf of a company, managing all employment responsibilities. This includes handling compliance, payroll, taxes, and employee benefits.

An EOR can operate either within the same country as the business it supports or in a different country, navigating varying employment laws to ensure compliance across borders.

What Does an EOR do?

The responsibilities of an Employer of Record (EOR) can differ based on the specific service and location. Below are some common tasks typically managed by an EOR

Compliance with local laws

An EOR provides guidance and support to ensure that employees are hired in compliance with local laws in each country or jurisdiction. They also offer legally compliant employment contracts. Since the EOR serves as the official employer, businesses can have peace of mind knowing that all legal obligations are being handled.

On-Boarding New Member

Once a business has found a new hire the EOR will onboard them, managing the employment agreement and setting up all the necessary processes necessary for the new team member to start at the company.

Running Payroll Internationally

Payroll and local taxes for both the employee and the employer will be fully managed by the EOR. The business’s team members will be paid by and receive pay-slips from the EOR.

Managing Compensation and Benefits

EORs often offer a variety of benefits but these vary from service to service. Benefits can include health insurance, time-off policies, parental leave, etc.

Complaint Hiring

Comply with local labor laws and ensure timely compensation for your workforce. Manage your international teams efficiently while avoiding expensive regulatory mistakes.

Bookkeeping Service

At DigitalSo, we provide a wide range of highly customizable bookkeeping services.

Professionally managed accounting records serve as a core foundation for a well-organized, well-informed, and successful business. To ensure you receive exactly what you need from our bookkeeping services, we recommend booking a consultation.

During your initial consultation, we will review the nature of your business, your recordkeeping requirements, and your expectations for financial records. Based on this discussion, we will determine the exact bookkeeping or other accounting services that best suit your needs.

Please feel free to browse through the list of our most commonly used bookkeeping services below:

-Monthly Bookkeeping

-Quarterly Bookkeeping

-Annual Bookkeeping

Monthly Bookkeeping

-Monthly transaction account processing

-General ledger maintenance

-Monthly bank reconciliation

-Monthly credit card reconciliation

-Monthly financial statements

-Year-end review

-Option to add payroll processing and tax filing, sales and use tax filing and income tax preparation and filing

Quarterly Bookkeeping

-Quarterly transaction account processing

-General ledger maintenance

-Quarterly bank reconciliation

-Quarterly credit card reconciliation

-Quarterly financial statements

-Year-end review

-Option to add payroll processing and tax filing, sales and use tax filing and income tax preparation and filing

Annual Bookkeeping

-Annual transaction account processing

-General ledger maintenance

-Annual bank reconciliation

-Annual credit card reconciliation

-Annual financial statements

-Year-end review

-Option to add payroll processing and tax filing, sales and use tax filing and income tax preparation and filing

Bank Reconciliation

Bank reconciliations are an important part of the bookkeeping process. A bank reconciliation allows you to determine the difference between you bank statements and your general ledger. A good practice is to have your accountant perform reconciliations on a monthly basis. By doing this, you will ensure that your bank account, your accounting records and your taxes are well organized and up-to-date. Well maintained books can lead to easier tax preparation and can allow you to extract important financial reports to determine how your business is doing on a month-to-month basis.

Bank reconciliations can allow you to:

-Determine how much bank charges are costing you each month

-Check if any errors were made by your bank in posting transactions

-Identify lost checks, lost depos Alliance System Solution and unauthorized wire transactions

-Update your books and extract financial statements and reports that can allow you to determine how your business is really doing

-Detect and prevent any unauthorized or fraudulent activities such as embezzlement of funds by someone within the business or any forged checks that might have been presented to the bank.

General Ledger

The general ledger is the central book in your accounting records. It is a record of all of your transactions and the accounts through which those transactions are posted. Proper maintenance of the general ledger can allow you to detect problems like unrecorded transactions (such as unrecorded payments) and double postings (such as double billings).